Now, more than ever, global trends such as changing demographics, digitialisation, energy transition, infrastructure renewal and sustainable development are driving significant demand for alternatives investing.

Investors are looking to protect the value of their investments and to diversify portfolios amidst market volatility. In this evolving environment, there is an opportunity to connect your clients with new opportunities.

Attractive alternatives

Private markets have grown to become an established part of many institutional investor portfolios. Today, the asset class is a major part of the investment landscape and the investment options are diverse – from corporate expansion and restructuring plans to venture capital, private lending, real estate, natural resources investments, and various forms of infrastructure equity.

Demand for infrastructure

Infrastructure has been growing in popularity in recent years, with unlisted infrastructure raising $US 87 billion of capital in 2024.1

As with most private markets investments, unlisted infrastructure has long been an area of the investment world that has typically been off limits to high-net-worth investors and traditionally reserved for institutional investors. However, several trends are helping to democratise access to unlisted infrastructure investments and a broader segment of individual investors are now able to consider whether – and how – to add unlisted infrastructure investments to a portfolio.

Infrastructure assets are large, physical assets that provide essential services to communities around the world. These assets typically have long-operational lives; stable cash flows; and operate in markets with high barriers to entry.

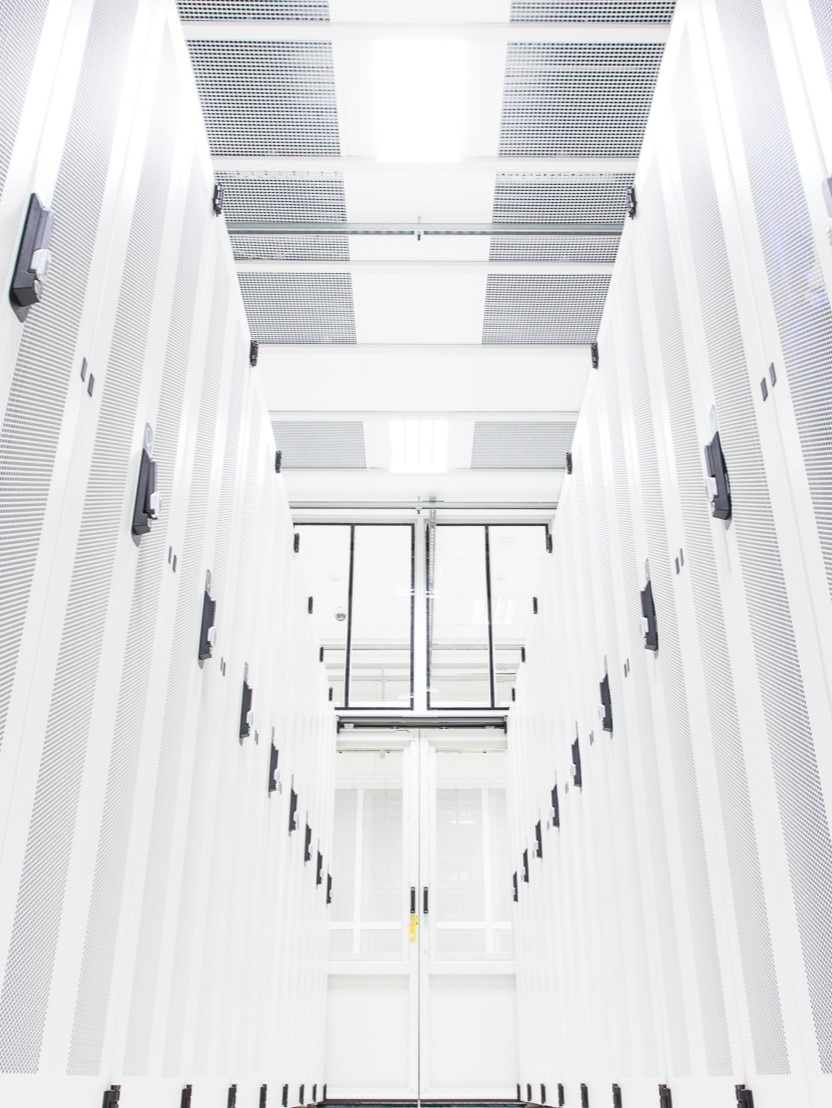

Digital infrastructure

- Broadcast transmission

- Carrier hotels

- Emergency communication systems

- Fibre networks

- Registries

- Wholesale data centers

- Wireless infrastructure

Source: MAM Internal Analysis. Please note that the above examples within the infrastructure sector are being provided as indicative examples only.

Energy transition

- Onshore and offshore wind

- Solar farms

- Geothermal generation

- Hydro generation

Source: MAM Internal Analysis. Please note that the above examples within the infrastructure sector are being provided as indicative examples only.

Utilities and energy

- Electrical generation (contracted)

- Gas and electricity transmission and distribution

- Water and treatment and distribution

- Waste collection and disposal

- Sorting and recycling

Source: MAM Internal Analysis. Please note that the above examples within the infrastructure sector are being provided as indicative examples only.

Transport

- Airport

- Light rail

- Ports

- Rails

- Toll roads

Source: MAM Internal Analysis. Please note that the above examples within the infrastructure sector are being provided as indicative examples only.

Contracted infrastructure

- Chemical parks

- Industrial gas

- Tank systems

- Waste industries

- Logistics

Source: MAM Internal Analysis. Please note that the above examples within the infrastructure sector are being provided as indicative examples only.

Social infrastructure

- Accommodation

- Education

- Healthcare

- Judicial and correctional facilities

Source: MAM Internal Analysis. Please note that the above examples within the infrastructure sector are being provided as indicative examples only.

Potential benefits of infrastructure

Infrastructure has been a stable asset class typically underpinned by strong economic fundamentals.

Consistent returns

The stable demand for essential services can translate into reliable and consistent returns

Downside mitigation

The critical need for infrastructure may provide some protection against market volatility

Diversification

Infrastructure often exhibits low correlation to other asset classes2

Stable yield

Long term contracts and regulated returns can contribute to stable and attractive yield

Inflation hedge

Infrastructure can include cost pass-through mechanisms which may hedge against inflation

Demographics

Growing urban centres have evolving needs. More than half the world currently lives within urban areas and by 2030 this number is expected to swell to about 5 billion. (Source United Nations Population Fund). But it’s not just about demographics. The pace, nature, and complexity of urban real estate and infrastructure is evolving too.

Communities need modern healthcare, living environments, workplaces, transportation, low carbon energy, circular economy waste management and a wide array of communication technologies and resources to support an insatiable appetite for data, among other solutions. There are more people, with a broader range of needs than ever before.

Digitalisation

Growing demand for technology and digitalisation has created the need for an entirely new class of real asset solutions in the form of data centres, fibre networks, communication channels and towers. It has also transformed how traditional infrastructure is designed and built, and how real estate is managed.

Management teams can design ‘digital twins’ to explore operating efficiencies, deploy remote sensors and drones to organise predictive maintenance, and artificial intelligence to accelerate decision making. The impact of technology on real estate and infrastructure investing is likely to continue to accelerate.

Decarbonisation

Infrastructure and real estate are expected to play a crucial role in transitioning to a net zero world, with substantial investment required to limit global warming and achieve net zero carbon emissions by 2050. According to Bloomberg New Energy Finance (BNEF), total investment in the energy transition between 2025 and 2030 will need to average around $US5.6 trillion per year to align with global net-zero targets.*

With governments globally more indebted than ever, this means there is a need and opportunity for private capital to step in and fill the investment gap.

*Source: Bloomberg NEF. (2025). Energy Transition Investment Trends 2025

Macquarie Asset Management has more than 30 years of experience creating, scaling, operating, and transforming infrastructure investments. With $A308.8 billion in infrastructure assets3 under management, we actively manage infrastructure and real assets used by approximately 290 million people everyday.4

Our infrastructure experts use deep technical insight and innovative capital strategies to create sustainable and resilient global infrastructure assets for our clients.

#1

infrastructure manager in the world5

30+

years of sector experience

290m+

people rely on our actively managed assets everyday4

Aligned Data Centers

Aligned Data Centers is one of the largest and fastest growing hyperscale data centre platforms in the Americas, specialising in build-to-scale facilities that support high density workloads. Aligned Data Centers is an underlying asset of the Macquarie Private Infrastructure Fund, which provides wholesale Australian investors a unique, single entry point to our global infrastructure platform.

1. BCG Infrastructure Strategy 2025 report.

2. Diversification does not ensure a profit or protection against a loss.

3. As at 31 December 2024. MAM defines AUM as proportionate enterprise value, calculated as proportionate net debt and equity value. MAM defines EUM as market capitalisation, plus fully underwritten or committed future capital raisings for listed funds and committed capital, less any called capital returned to investors for unlisted (private) funds. This includes capital invested in other MAM-managed businesses. For jointly managed funds, the amount is representative of MAM’s economic ownership of the joint-venture manager. Adjustments are made when MAM-managed funds invest in other MAM-managed funds

4. As of March 31, 2024. Number of people reached is calculated by taking an estimate of the number of users for all MAM Real Assets portfolio companies. Examples include a specific toll road where the number of vehicles per day has been multiplied by the average number of passengers in a vehicle (average passengers in a vehicle is ~2, not dependent on country); a particular power generation asset where the amount of GWh it generates per year is divided by the average power consumption in the country where the asset is located. Portfolio company data is collected from MAM’s asset management teams on a bi-annual basis.

5. IPE Real Assets Top 100 Infrastructure Investment Managers 2025, published in July/August 2025. The ranking is the opinion of IPE Real Assets and not Macquarie. No such person creating the ranking is affiliated with Macquarie or is an investor in Macquarie-sponsored vehicles. IPE Real Assets surveyed and ranked global infrastructure investment managers. The ranking is based on infrastructure AUM as at 31 March 2025. AUM is defined by IPE Real Assets as the total gross asset value of all assets managed and committed capital (including uncalled). There can be no assurance that other providers or surveys would reach the same conclusions as the foregoing.

This information has been prepared by Macquarie Specialist Investment Management Limited (ABN 84 086 438 995 AFSL 229916) the issuer of units in the Fund(s) referred to above. The Fund(s) referred to above is only open to investment by wholesale clients (as defined in section 761G of the Corporations Act). The Fund(s) is not offered in the United States or to any US Persons. The information on this page is general information only and does not take account of the investment objectives, financial situation or needs of any person. It should not be relied upon in determining whether to invest in the Fund. In deciding whether to acquire or continue to hold an investment in the Fund(s), an investor should consider the Fund's information memorandum. The information memorandum is available by contacting us on 1800 814 523. This information is intended for recipients in Australia only.

Nothing in this document constitutes a recommendation to buy, sell or hold any financial product, security or instrument.

Future results are impossible to predict. This document contains opinions, conclusions, estimates and other forward-looking statements which are, by their very nature, subject to various risks and uncertainties. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in such forward-looking statements.

Past performance information shown herein, is not a reliable indicator of future performance. No representation or warranty, express or implied, is made as to the suitability, accuracy, currency or completeness of the information, opinions and conclusions contained in this document. In preparing this document, reliance has been placed, without independent verification, on the accuracy and completeness of information available from external sources. To the maximum extent permitted by law, no member of the Macquarie Group nor its directors, employees or agents accept any liability for any loss arising from the use of this document, its contents or otherwise arising in connection with it.