Commodities

| Sector | Commodities |

| Sub-sector | Metals and mining |

| Location | South Africa; Australia |

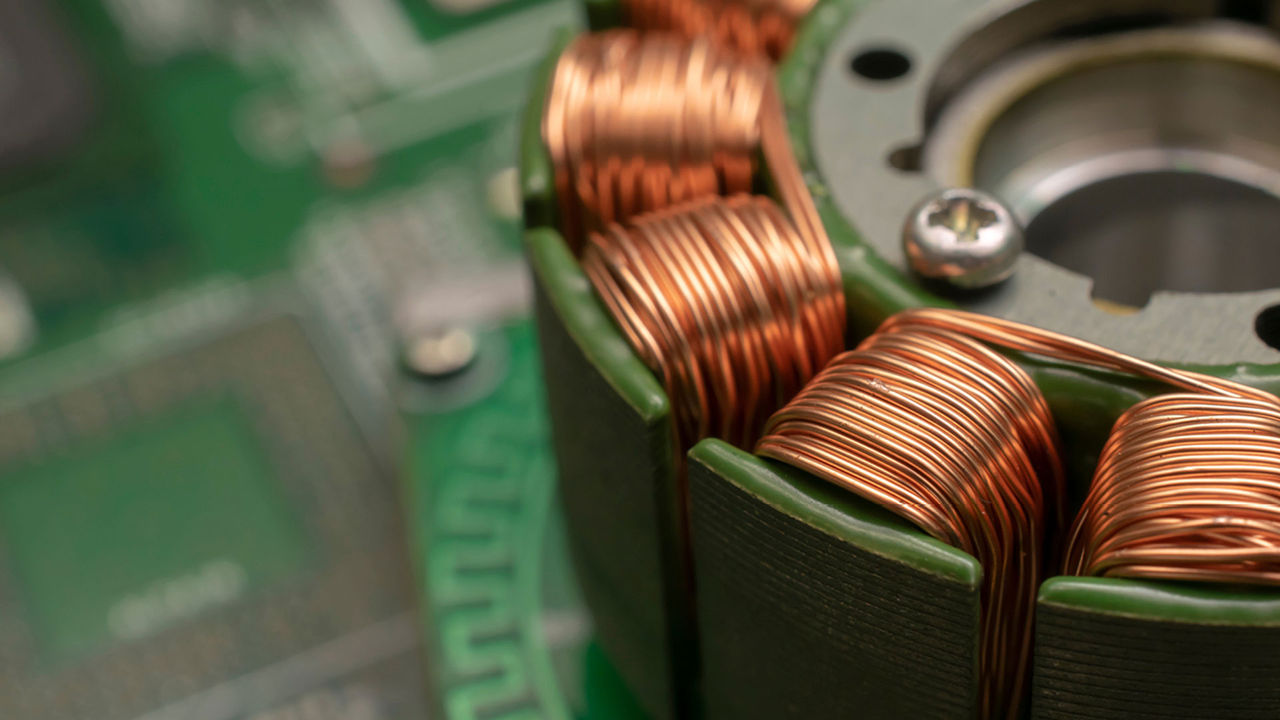

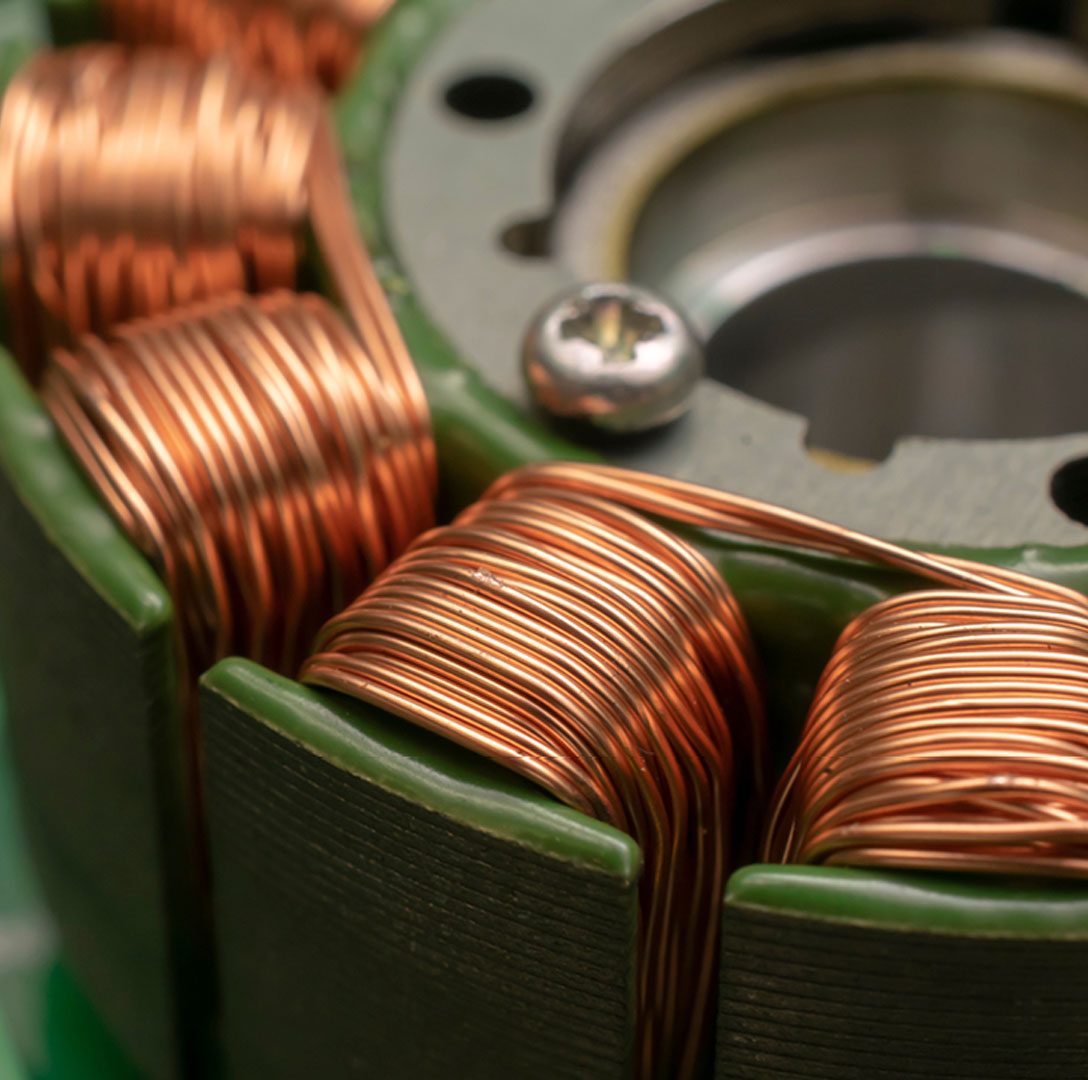

Harmony Gold Mining Company Limited (Harmony) is a world-leading gold mining specialist.2 Over its 75 years of operations, Harmony has become South Africa’s largest gold producer by volume, with over 20 years of experience operating across the APAC region.3 The company is developing a growing international copper footprint as a part of its expansion strategy, diversifying its production offering to facilitate the global shift toward renewable energy infrastructure.4

In 2025, the price of gold surged by 66 per cent – its steepest climb since 19795 – driven by the interconnected global factors of geopolitical tensions, inflation, central bank purchasing, currency volatility and supply constraints.6 South Africa boasts a strong history as a leading gold producer, and its gold mining companies are leveraging this opportunity to capitalise on favourable gold market conditions by implementing strategies to diversify their jurisdiction and/or commodity exposure.

MAC Copper owned and operated the high-grade CSA Mine in New South Wales, Australia, which produced over 40,000 tonnes of copper in 2024.7

Macquarie Capital leveraged its extensive industry expertise as Africa’s leading M&A mining adviser8 to assist Harmony in assessing the opportunity and implementing its acquisition strategy. This builds on Macquarie Capital’s previous advisory services in the region, including:

The team’s capabilities were further bolstered through collaboration with Macquarie’s Commodities and Global Markets Mining Finance team, who acted as an initial mandated lead arranger and underwriter for the $US1.25 billion acquisition-linked bridge finance facility. By leveraging their respective targeted expertise, both funding and transaction advisory services were delivered throughout the acquisition.

Macquarie Capital utilised a cross-regional advisory team throughout Australia and EMEA that had previous engagements with Harmony, working with the company to navigate a series of transaction complexities, including managing stakeholder negotiations amidst a period of heightened market volatility. Macquarie Capital facilitated the successful structuring of the transaction, despite numerous strategic shareholdings in MAC Copper and existing complex financing arrangements.

Outcome

The addition of immediate copper production from the CSA Mine will support the development of Harmony’s regional growth assets, and will benefit from the demand for copper across electric vehicles and power grid infrastructure.9

The transaction provides a strong strategic fit for Harmony’s growth aspirations, creating a de-risked and geographically diversified gold and copper portfolio. Through CSA and Harmony’s Eva Copper project, Harmony has the potential to become a ~100,000 tonnes per annum copper producer on the East Coast of Australia within the next five years.4

acquisition of MAC Copper, Harmony’s largest-ever acquisition

of copper production recorded from the CSA Mine in 20247

of copper anticipated to be produced by Harmony on the East Coast of Australia from the CSA Mine and the Eva Copper project4

Africa’s leading M&A mining adviser8

Learn more