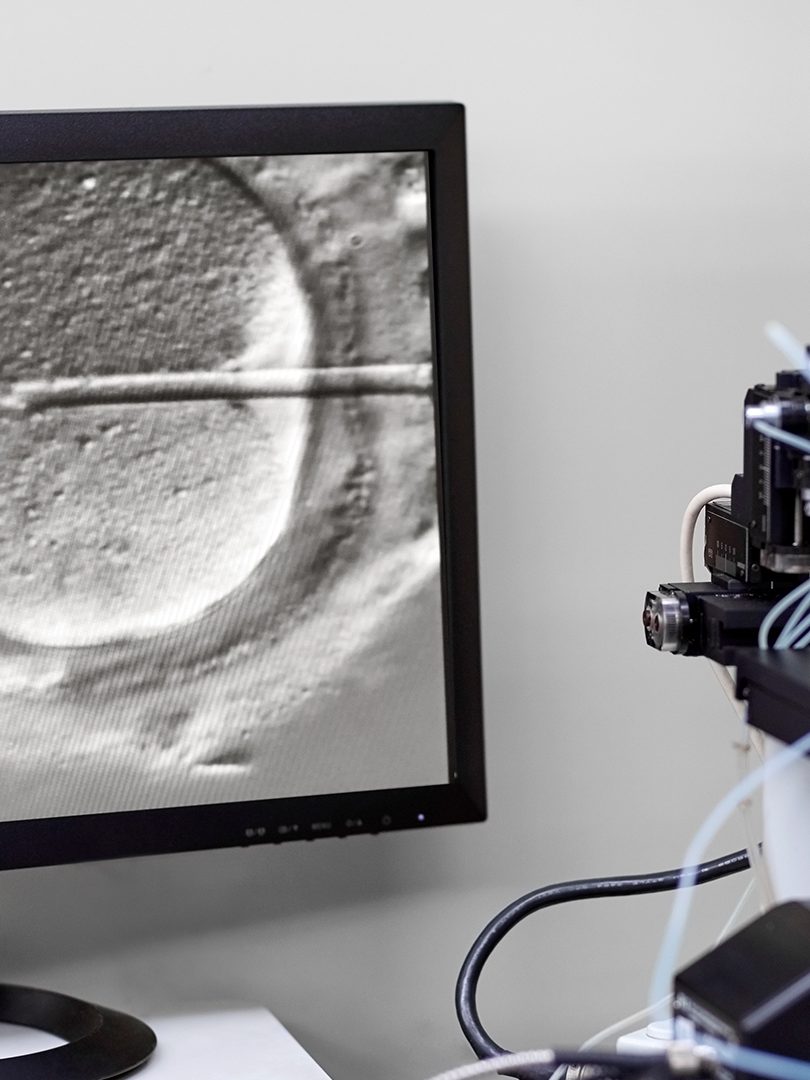

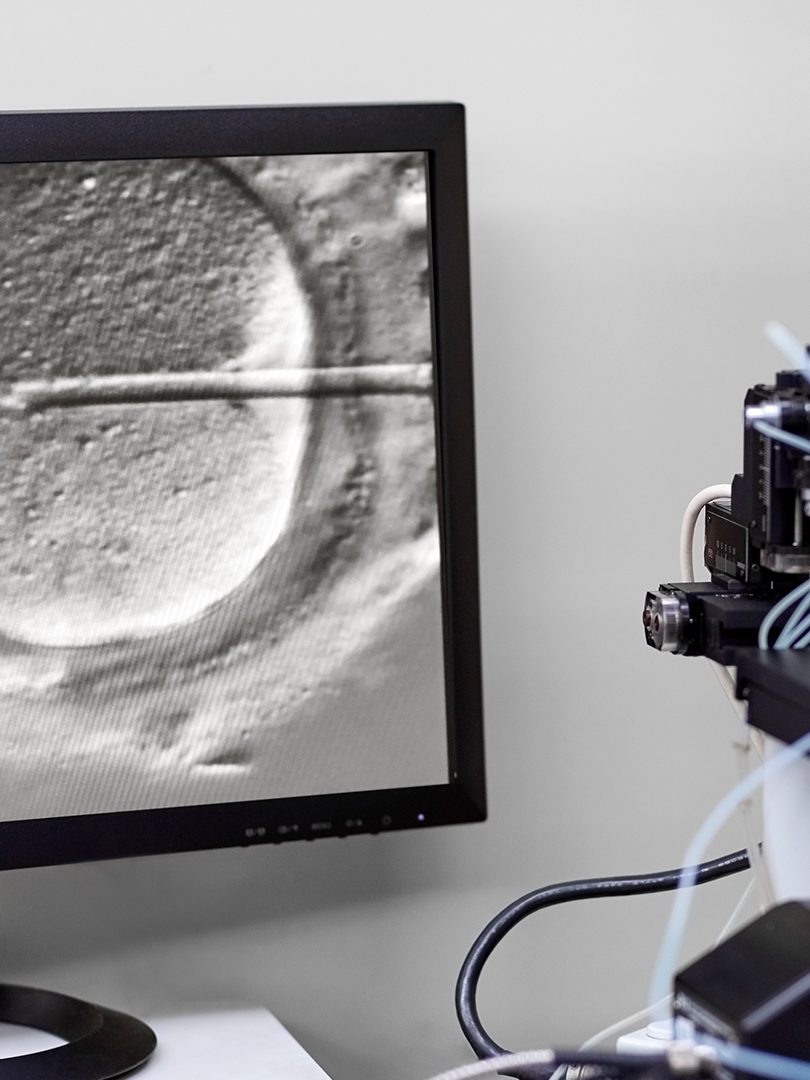

Healthcare

| Sector | Healthcare |

| Sub-sector | Services |

| Location | Australia |

The capital raise was conducted in the context of national restrictions on non-urgent elective surgeries, including IVF, which had materially impacted Monash IVF’s operations and caused widespread equity capital market disruption.

Macquarie’s long-term relationship with Monash IVF since executing its IPO in 2014 allowed the experienced healthcare and Equity Capital Market teams to develop and execute the fully underwritten proposal within a tight timeframe.

Based on Macquarie Capital’s deep knowledge of the healthcare services sector, and following extensive modelling for the recommencement of elective surgeries post-COVID-19 shut down, Macquarie Capital was able to advise Monash IVF on a complete solution to trade through various revenue scenarios.

Macquarie Capital has Australia’s largest Equity Capital Market franchise and was able to use its strong recent experience executing balance sheet fortification raisings during the COVID-19 crisis to successfully undertake the raising for Monash IVF.

Outcome

The Placement and Institutional Entitlement Offer shortfall received strong support from a range of existing and new investors.

Retail investors and Monash IVF Doctors also participated in the offer, with an oversubscription facility implemented to facilitate additional participation.

~154 million shares were issued representing ~65 per cent of existing Monash IVF shares on issue.

take-up rate from eligible institutional shareholders

discount to TERP

Learn more