Commodities

| Sector | Commodities |

| Sub-sector | Metals and mining |

| Location | Australia |

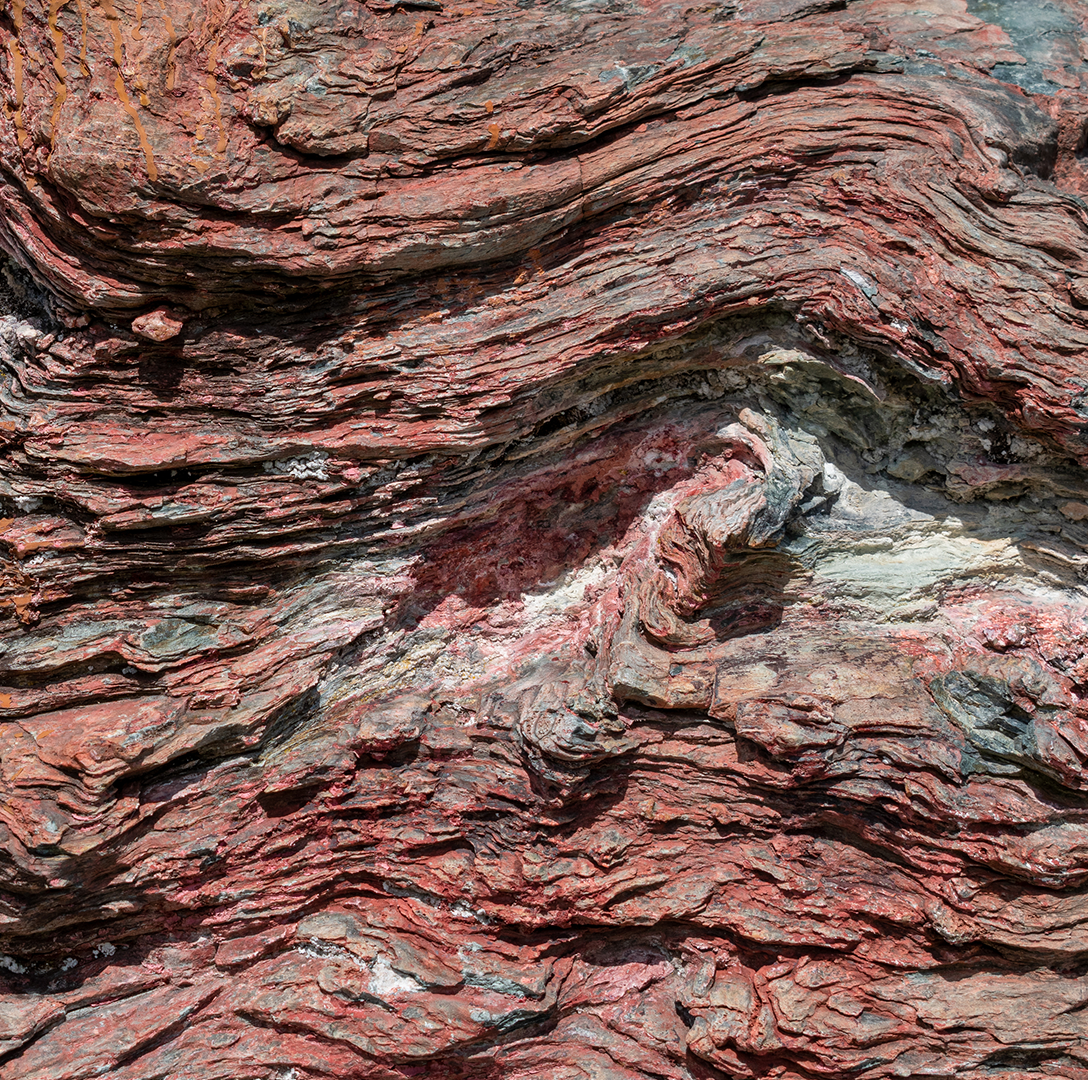

VOC Group Limited (VOC Group) is a private company and the 50 per cent shareholder in Wright Prospecting, the entity established by mining entrepreneur Peter Wright who – alongside Lang Hancock - played a key role in discovering Western Australia’s Pilbara iron ore region.

VOC Group held a 25 per cent interest in Rhodes Ridge through a complex joint venture, Rhodes Ridge Joint Venture (RRJV). With no ambition to directly participate in the development of a project of this scale and seeking to strategically rationalise its portfolio, VOC Group sought to sell the project to a strong custodian who could support the long-term development of Rhodes Ridge and support the future of Western Australia’s mining sector.

Japanese headquartered Mitsui & Co (Mitsui) had existing strategic stakes in the Australian iron ore industry dating back to the 1960s, including the Robe River iron ore project operated by Rio Tinto. Rhodes Ridge is also operated by Rio Tinto as 50 per cent owner of the RRJV.

This included collaborating with technical consultants to develop a credible business case and facilitating negotiations with the Federal government and the Western Australian Government to ensure regulatory alignment and smooth execution.

The transaction included innovative deal features and was structured to withstand significant iron ore market volatility, including a 25 per cent fall in prices during negotiations. This volatility required careful structuring and negotiation to ensure the deal remained attractive and viable for both parties.

Outcome

The deal unlocked substantial value for VOC Group and enabled the company to monetise an illiquid asset, avoid future capital commitments and ultimately unlock significant value.

In parallel, Mitsui undertook a transaction with VOC Group’s JV partner, AMB Holdings Pty Ltd (AMBH), on the same economic terms determined by VOC Group, to acquire an additional 15 per cent interest in the RRJV for $US1.9 billion, taking the total transaction value to $A8 billion, Mitsui’s largest single investment in its 350-year history.

It further solidifies Mitsui’s strategic presence in Australia’s iron ore sector, complementing its existing interests, and signals a strong international vote of confidence in the Western Australian resources sector and regulatory environment. Japan has been a long-standing partner in the Western Australian mining sector, and this deal reinforces the relationship between the two countries, strengthening bilateral ties and signals a shared commitment to resource security.

The transaction’s successful restructuring demonstrates Macquarie Capital’s deep expertise in the sector and can serve as a blueprint for modernising legacy joint venture structures, a common challenge in the M&A landscape for mature resource projects. The partnership between VOC Group, Mitsui, Rio Tinto and the Western Australian Government also aided in ensuring parties are aligned in the project’s development and long-term vision. The success of this deal showcases effective collaboration, which can serve as a model for further international investments in the Australian resources sector.

acquisition

in Mitsui’s 350-year history

ever paid for a development stage mining asset on a 100 per cent basis

Australian-inbound M&A transaction in metals and mining in the past 10 years

Macquarie Capital was the only financial adviser on the transaction across VOC Group, AMBH and Mitsui, requiring us to play a pivotal role over a five-year engagement term across transaction management, due diligence, execution, and negotiations to drive a successful outcome for VOC Group.”

Russell Keating

Global Head of Critical Minerals & Energy

Macquarie Capital

1. ‘Joint Rhodes Ridge iron ore project gets green light’, WA Government, October 2022, https://www.wa.gov.au (Accessed: January 2026)

Learn more